The challenge is that this data – especially claims and remittance/payment data – is typically collected by and siloed in multiple departments, including coding and revenue cycle management. These silos put the organization at risk by preventing a 360-degree vantage point. While each stakeholder sees what they need, bringing all the information together gives the organization a much stronger chance to have a healthier bottom line.

Another challenge is that many healthcare organizations – an estimated 31% – still use spreadsheets to manage their audit programs.1 What is required is an advanced audit platform capable of pulling all this data together and putting it into a consumable format to help inform strategic decisions for the organization. For one health system, deploying such a platform enabled the identification of $18.5 million in cash acceleration opportunities.2

Data Utilization

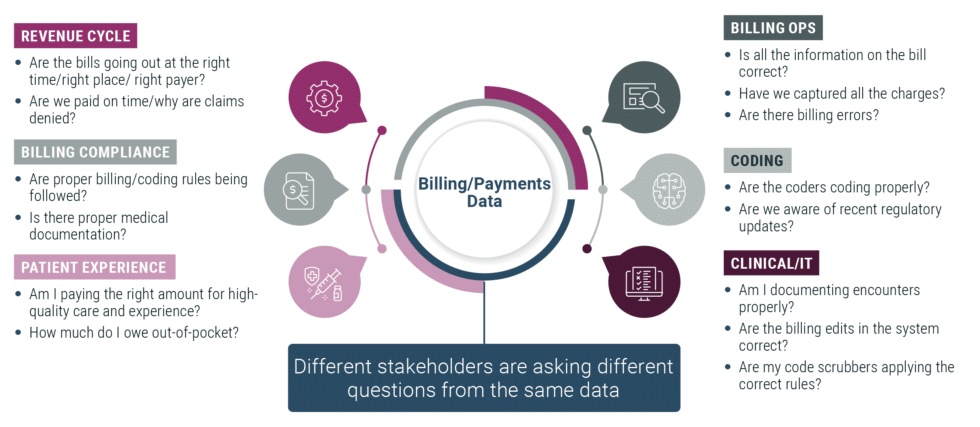

From Coding to Compliance, different stakeholders glean different information from the same data. For example, on the Revenue Cycle side, they seek to determine if bills are going out on time to the right payer, and recognizing the maximum reimbursements.

In Billing Operations, identifying billing errors and ensuring completeness of charge capture are primary focuses. Coding looks at whether coders are properly coding patient records to the highest accuracy and specificity and properly applying any recent regulatory updates. Clinical folks need to know if they are properly documenting the services that were rendered in the patient record. Information Technology (IT) needs to know whether encounters are properly documented, as well as whether the correct billing edits are in the system. They also monitor whether code scrubbers are applying the right rules – and applying them accurately.

Finally, in Billing Compliance, data is analyzed to ensure proper billing and coding rules are followed and whether the medical documentation is accurate and appropriate.

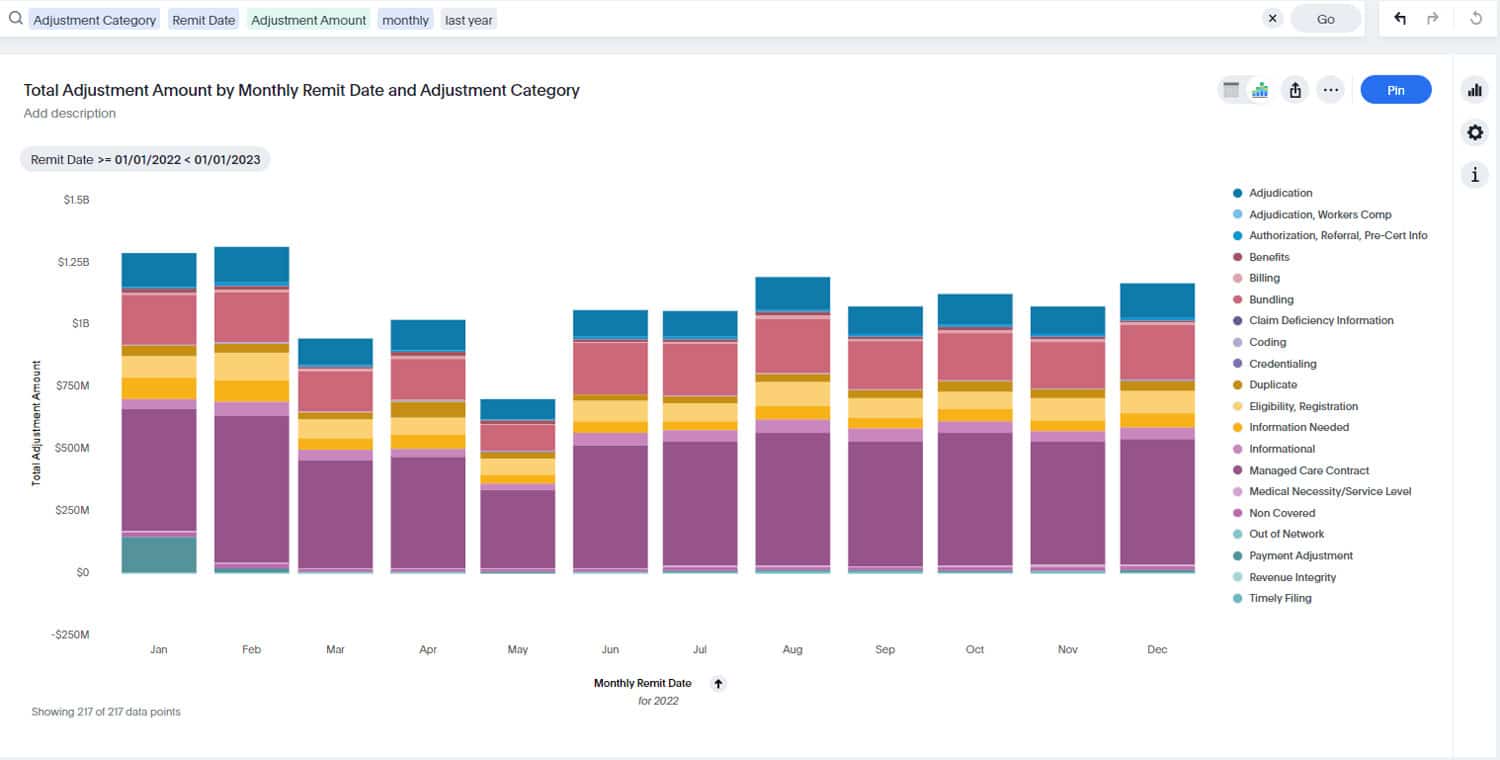

There is much to be gleaned from slicing and dicing this data by individual departments. However, its full power is realized when it can be aggregated across the organizational continuum, and sophisticated analytics, dashboards, and viewpoints are applied so everyone can see the same data simultaneously. This allows multiple departments to work toward common goals of optimizing the revenue cycle and achieving revenue integrity versus informing individual departmental strategies.

The Power of Aggregation

Reliance on spreadsheets or technology that doesn’t aggregate data across departments prevents the caliber of analytics and information sharing necessary to drive organization-wide strategic decision-making. What is needed is a platform capable of taking in the massive amounts of RCM data an organization generates daily, aggregating and analyzing it, and returning it to the various stakeholders in meaningful and actionable formats.

This was the case for a multispecialty group with 1,200 physicians and 250 midlevel providers across 40 specialties based in the mid-Atlantic region of the U.S. Its Compliance team wanted to leverage internal data to plan risk-based audits based on the potential risks that are unique to an academic group practice, such as new provider audits and under/over-coding. However, being limited to routine audits made it difficult to identify the trends necessary to effectively address these types of issues. And once a trend was identified, manual reports would have to be created using specific parameters to ensure the right data was compiled – reports that would have to be run by the organization’s IT department without the benefit of real-time data.

The team would also need to ensure it was requesting reports monthly or quarterly so identified issues would be tracked over time, which took auditors away from their greater responsibilities of auditing additional risk areas and looking at new issues as they are identified. As a result, while they were effectively auditing, educating, and training, as well as taking corrective action on a small scale, the monitoring component was missing.

Overcoming Limitations Through Automation

The organization deployed MDaudit to provide a comprehensive view of real-time information that would allow the Compliance team to tap real-time claims data to identify and monitor trends and issues without relying on other departments for reports. The platform brings together billing compliance and revenue cycle departments – two critical areas that have traditionally operated in silos, creating a fragmented approach to revenue integrity.

One of the first success stories to emerge from the use of the new platform by the practice was the identification of one practice that was an outlier for the rate of denials for Evaluation & Management (E&M) services. By drilling down into the metric, they were able to determine what the claims had in common, including the specific location and group of providers that was the source of the issue, which enabled them to add an edit into the billing system and alert the practice that they would continue monitoring the situation.

Ultimately, the team saw a real-time drop in the percentage of times the group incorrectly used a modifier 25 on their established patient visit coding, down from approximately 30% to under 10. Ongoing monitoring to ensure the percentages do not creep back up also saves time and eliminates the need to conduct additional audits of dozens of similar cases to ensure the modifier’s use is reasonable.3

Getting Ahead of Systemic Risks

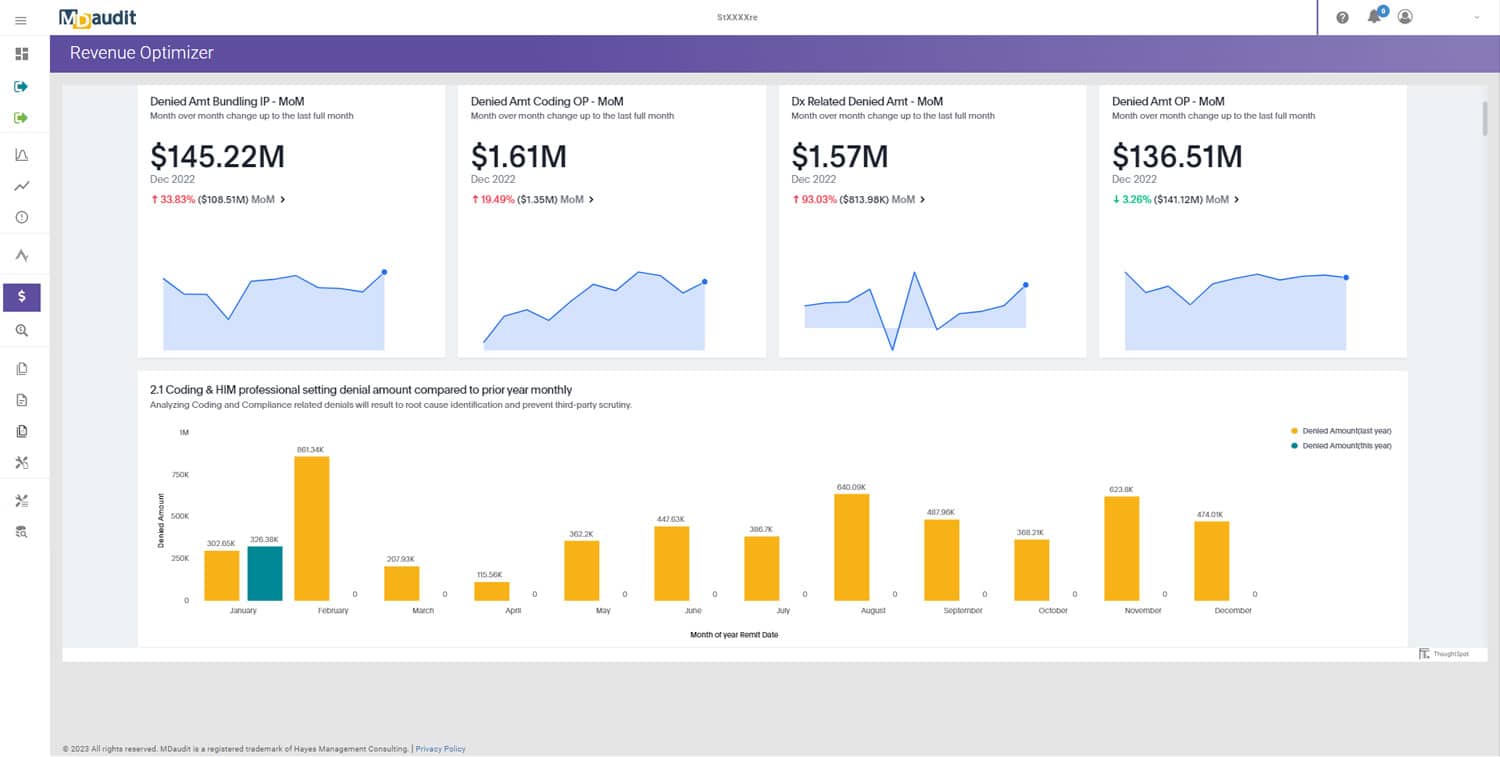

The ideal solution combines fully integrated risk capabilities and supporting workflows on a single platform, providing end-to-end denials analytics technology designed to pre-emptively protect against revenue leakage by identifying and resolving systemic risks based on historical data and applied insights. This allows organizations to proactively address the issues that lead to costly inpatient and outpatient claim denials by creating a closed-loop feedback process between insights, action, and outcomes to manage high-impact denials and improve overall revenues.

This was the experience of another MDaudit user, a regional, integrated healthcare provider/payer system with 230 locations, including six acute care hospitals and 22 urgent care facilities. The organization deployed the platform as part of its transformational excellence initiative, encompassing operational improvements, including a move toward risk-based auditing for enhanced revenue integrity. Risk-based auditing leverages ongoing monitoring, benchmarking, and trending review to identify areas of risk within the coding, billing, and compliance processes. Once revealed, these risk areas can be added to analytics metrics and tracked from audit through reporting to follow-up in a closed-loop process that corrects and eliminates underlying problems impacting revenue integrity.

MDaudit has been the springboard to streamlined workflows, greater accuracy, and enhanced efficiencies. It has also become a valuable tool for provider education around appropriate coding and optimizing revenue capture. The ability to track and transform denials and benchmarking has been particularly helpful. Specifically, presenting benchmarking data to practice directors as part of the health system’s operational improvement processes has helped drive home some points about revenue capture. It has also helped identify providers who are not aligned with national benchmarks.

The platform had an immediate and significant positive financial impact resulting from additional revenue and high-risk-initiated audits, including identifying approximately $148,000 in charges that had been billed incorrectly and $4.5 million in at-risk revenues for COVID-19-related services. By leveraging the MDaudit platform, the coding compliance team was also able to identify $18.5 million in cash acceleration opportunities, such as fewer days in A/R and ensuring use of the highest appropriate level for coding.4

The most impactful platform will deliver workflow automation, risk monitoring, and built-in analytics and benchmarking capabilities. It will be powered by augmented intelligence and expertise in providing proven revenue cycle management services and solutions to the nation’s leading healthcare provider organizations. This, in turn, drives improved outcomes through actionable analytics and empowers healthcare organizations to achieve unparalleled efficiency, reduce compliance risk, and retain more revenue.

Conclusion

By identifying, prioritizing, and addressing denial risks with the greatest financial cost, end-to-end auditing platforms optimize and target internal resources for maximum impact. They provide greater visibility of revenue risks across revenue integrity, revenue cycle, billing compliance, coding, clinical documentation, and other teams and support improved financial decisions, forecasting, risk management, and strategic use of internal resources.

Further, end-to-end auditing platforms aggregate and generate data in a way that informs retrospective and prospective audits driving continuous billing compliance, coding improvements, and stakeholder education. Thus, by deploying technology that allows comprehensive data to be used to inform critical decisions, healthcare organizations can optimize revenues and keep their doors open.

1 The Audit Crunch: Post-Payment Reviews on the Rise as Staffing Levels Plummet – ICD10monitor

2 Six Hospital Health System Case Study – MDaudit (hayesmanagement.com)

3 1200+ Multispecialty Physician Group Case Study – MDaudit (hayesmanagement.com)

4 Six Hospital Health System Case Study – MDaudit (hayesmanagement.com)