Much has changed across the healthcare landscape over the past five years, most of it fueled by workflow changes necessitated by a global pandemic. Medical billing compliance has not escaped these changes, which has increased pressure on shrinking auditing teams.

Five years ago, retrospective audits were the norm, auditing a select number of claims from each provider and each coder once a year. Today, using only retrospective audits can harm an organization’s finances by delaying the payment of claims, restricting revenue, and perpetuating errors that can bring organizational audits from federal and commercial payers.

MDaudit research shows a 31% increase in prospective audits over 2021, and a 28% uptick in risk-based audits. Auditing prospectively and using data analytics to determine your top billing concerns and areas of focus can make auditing staff more efficient and drive revenue enhancements.

Prospective Audits Help Medical Billing Compliance Teams Work Smarter

Auditing staff was not immune from the Great Resignation that affected all areas of healthcare. Fewer staff mean larger individual workloads, causing many organizations to depart from the “every provider/coder, every year” auditing approach. An organization’s best compliance professionals often get poached by other companies, and the hiring process means a staff reduction for months until an adequate replacement is found — if that position gets approved to be filled in the first place.

Prospective auditing and risk-based analysis work together to help auditors identify the areas where they should concentrate their efforts to bring the most value to the organization. Say your organization has 1,000 providers. Performing risk-based analysis can identify those providers and coders who are responsible for the most under- or over-coding, narrowing the list of audit targets considerably.

Refining the target list allows auditors to focus more on determining the problem areas, providing additional training on standards, and correcting claims before they are submitted, which speeds up payment. According to MDaudit research, the time lag from claim submission to initial payer response for all types of claims continues to increase, adding pressure on operational teams to ensure claims are correct on the first pass.

How to Shift to a Prospective Audit Process

Adopting a prospective audit approach does not eliminate the need for retrospective auditing. Our recommendation is that audits should be a 50/50 mix of retrospective and prospective auditing. For medical billing compliance staff that are 100% reliant on retrospective audits, the key is to start small. Consider these areas on the path toward prospective auditing:

- New providers and new coders. New employees pose a compliance risk to the organization because their ability to code correctly is unknown. It’s better to teach people how to code properly in the first place, rather than correcting errors that can delay payments for months.

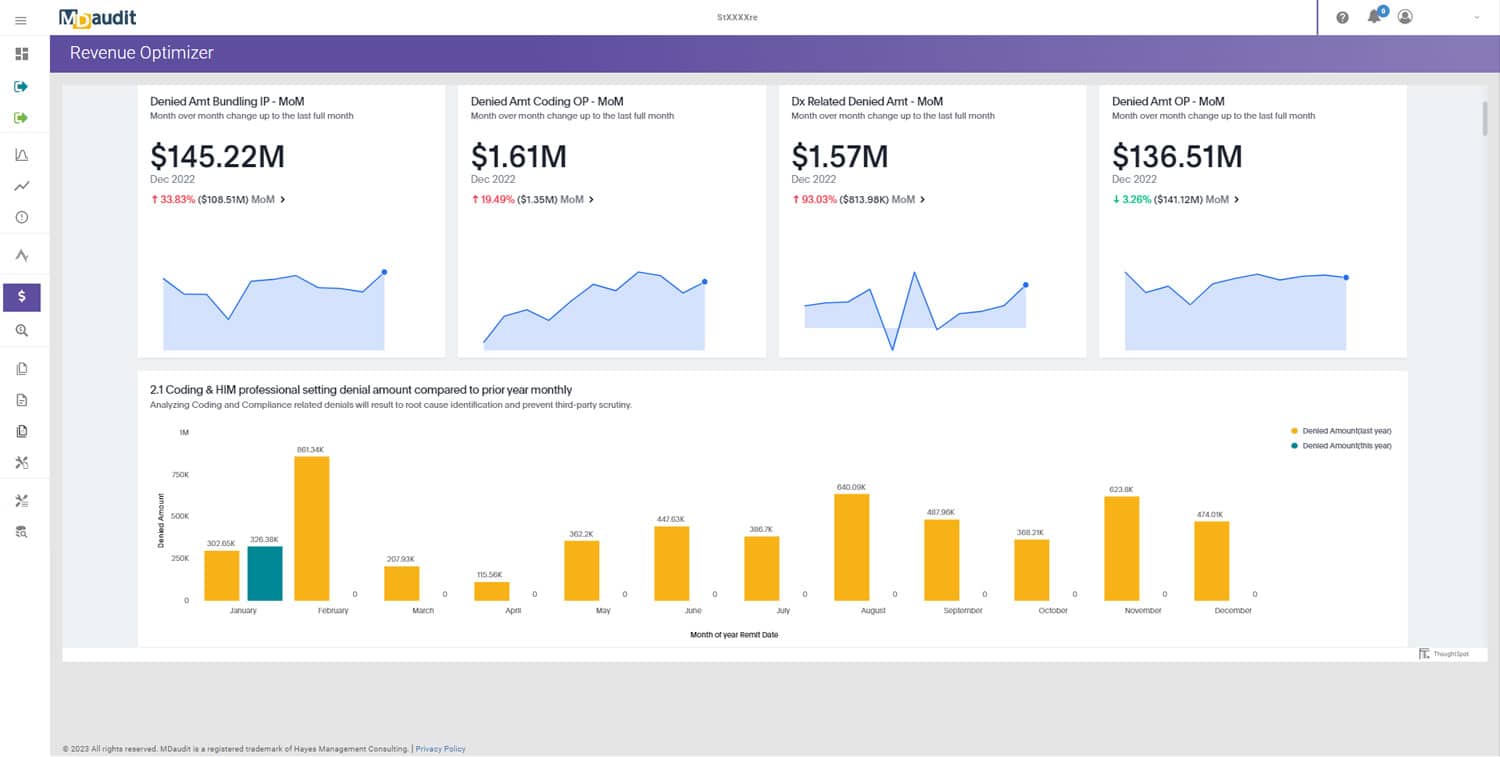

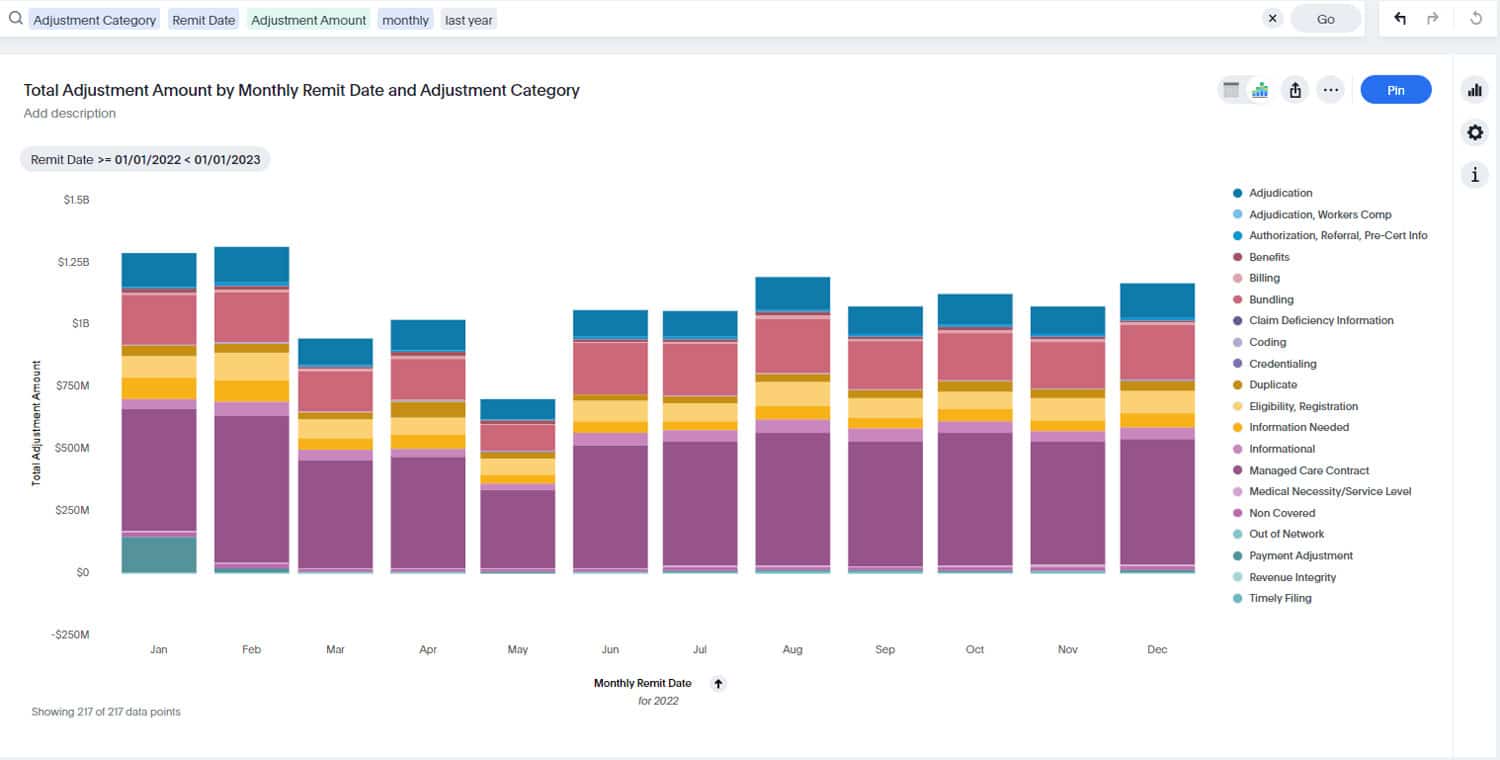

- Providers and departments with outsized numbers of denials. By analyzing retrospective denial data, auditors can identify those providers, coders, and specialties/procedures that incur the greatest number of denials. Focusing on those subsets can bring greater returns to the organization than treating all providers, coders, and departments equally.

- High-dollar DRGs. Our research shows that hospitals, for example, have a $2,900 revenue opportunity for each missed or wrong DRG code – an amount that adds up quickly. Correctly coded DRGs could mean an additional $2.9 million in revenue. This focus could include DRGs with major complication or comorbidity (MCC) and complication or comorbidities (CC) designations.

- CMS-HCCs. For facilities that accept certain Medicare Advantage plans, payment can vary based on hierarchical condition categories (HCCs), which assign higher payments to more serious medical conditions. Payers are devoting more resources to external audits, which can be costly to organizations in terms of labor hours and potential return of overpayments. For example, in October, Blue Cross Blue Shield of Tennessee agreed to repay $7.8 million following an audit of Medicare Advantage claims.

Increase Auditing Efficiency with Technology

Medical billing compliance doesn’t have to be complex, particularly with a powerful set of tools designed to help auditors increase efficiency and bring a more strategic approach to auditing through automation.

Examine all chart types within your organization from both prospective and retrospective viewpoints to identify risks, determine the root cause of errors, and apply corrective actions to prevent future losses. Robust audit reporting capabilities and advanced analytics dashboards help users uncover insights quickly, bringing additional revenue to the organization quicker by reducing the incidence of denials.

Read more about how technology can greatly increase efficiency among teams and for the organization as a whole.