THE CUSTOMER PROFILE

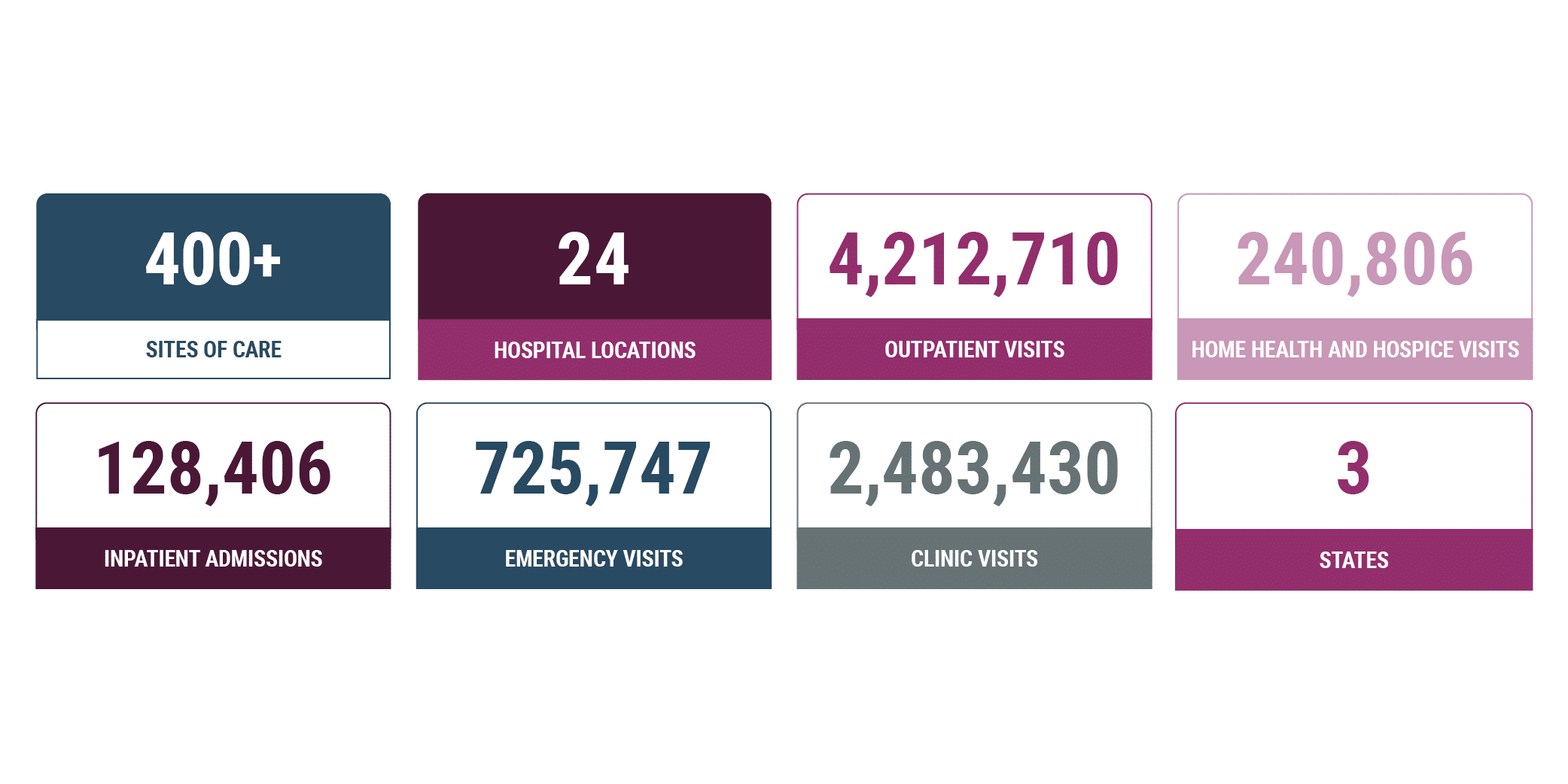

Faith-based, nonprofit customer is an integrated health system serving more than 80 communities across Oregon, California, and Hawaii. The team of 37,000 employees, providers, and volunteers delivers care across more than 400 sites, including five critical access and 19 acute care hospitals, clinics, hospice and home care agencies, and retirement centers.

The customer has long been a promoter of prevention and wholeperson care, with a vision to transform its communities by improving physical, mental, and spiritual health, enhancing interactions, and making care more accessible and affordable.

THE CHALLENGE

Increased Medicare RAC audit scrutiny threatened potentially devastating financial risk.

Amid lower patient volume and increased external audits, health systems are more pressed than ever to protect revenues – a challenging task made even more challenging with limited human resources.

The Director of Revenue Cycle Compliance (RCC) describes her team as “small but mighty.” As in many health systems across the country, this team has decreased in size with recent budget cuts. In a system with more than 20 facilities and 3,200 beds, the group of three acute hospital billing auditors, two professional billing auditors, and one manager have their work cut out for them.

Historically, the revenue cycle compliance team focused exclusively on audits. Two professional billing auditors conducting provider-specific audits were spread thin, able to audit a small percentage of the more than 1,200 providers each year. Meanwhile, hospital auditors were limited to the OIG work plan or other general risk areas. “It has become critical in our department to maximize our abilities to be able to keep an eye on the system and look for risks that could impact us,” explains the Director of RCC.

A recent external audit denial revealed one such significant risk for the customer. The RAC reversed an initially paid claim that included a charge for a leadless pacemaker. At more than $100,000 per claim across multiple facilities, the denial risk amounts to $8 – $10M per year. The denial was part of a larger trend of increased scrutiny by Medicare and its contractors aimed at reducing Medicare costs. In this case, the pacemaker charge requires a Medicare Coverage Evidence Development (CED) designation.

The Director added “These denials have the potential to be financially devastating. We had to identify the reason for the denial and communicate it across the health system as quickly as possible. When this issue came to light, we had three facilities and numerous departments impacted. Cardiac departments, case managers, materials management, supply chain services, and leadership all wanted to know how we were going to fix this – and fix it fast.”

THE SOLUTION

MDaudit helps identify denials risks and their root causes – even before payer adjudication – to decrease denials, shorten payment lag time, and increase cash flow.

MDaudit Denials Predictor reviews charges and intercepts those likely to result in denials or delays prior to payer adjudication. Using a custom rule, the customer is leveraging the powerful and adaptive payer-centric rules engine to identify accounts that fall under the Medicare CED program.

“To be able to find a vulnerability and then pinpoint and validate one field on a claim – that’s the level of finesse you can get from MDaudit. With Denials Predictor, I have a simple solution that will stop claims from going out the door without the appropriate designation. It’s insanely powerful. The technology is fantastic” added the Director of RCC.

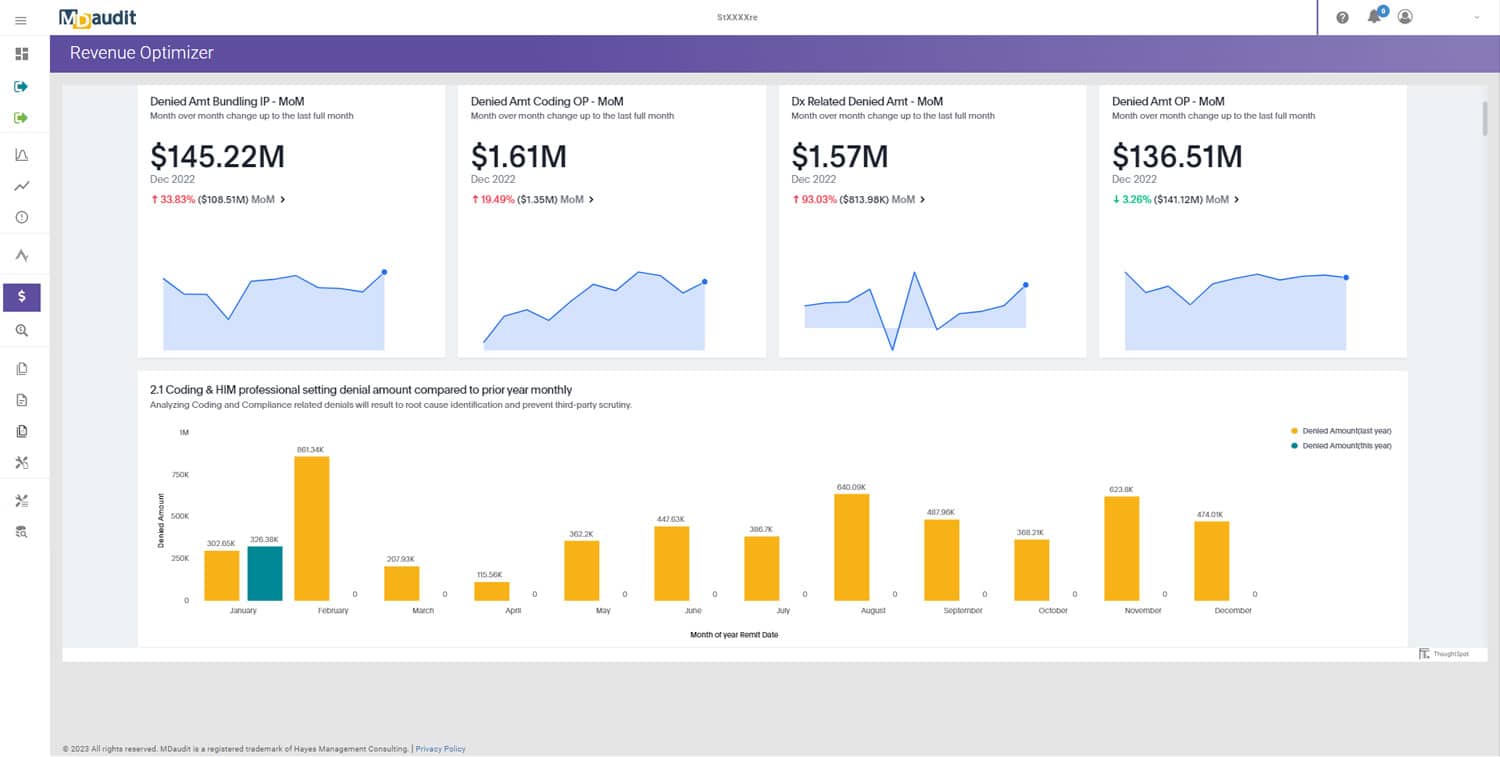

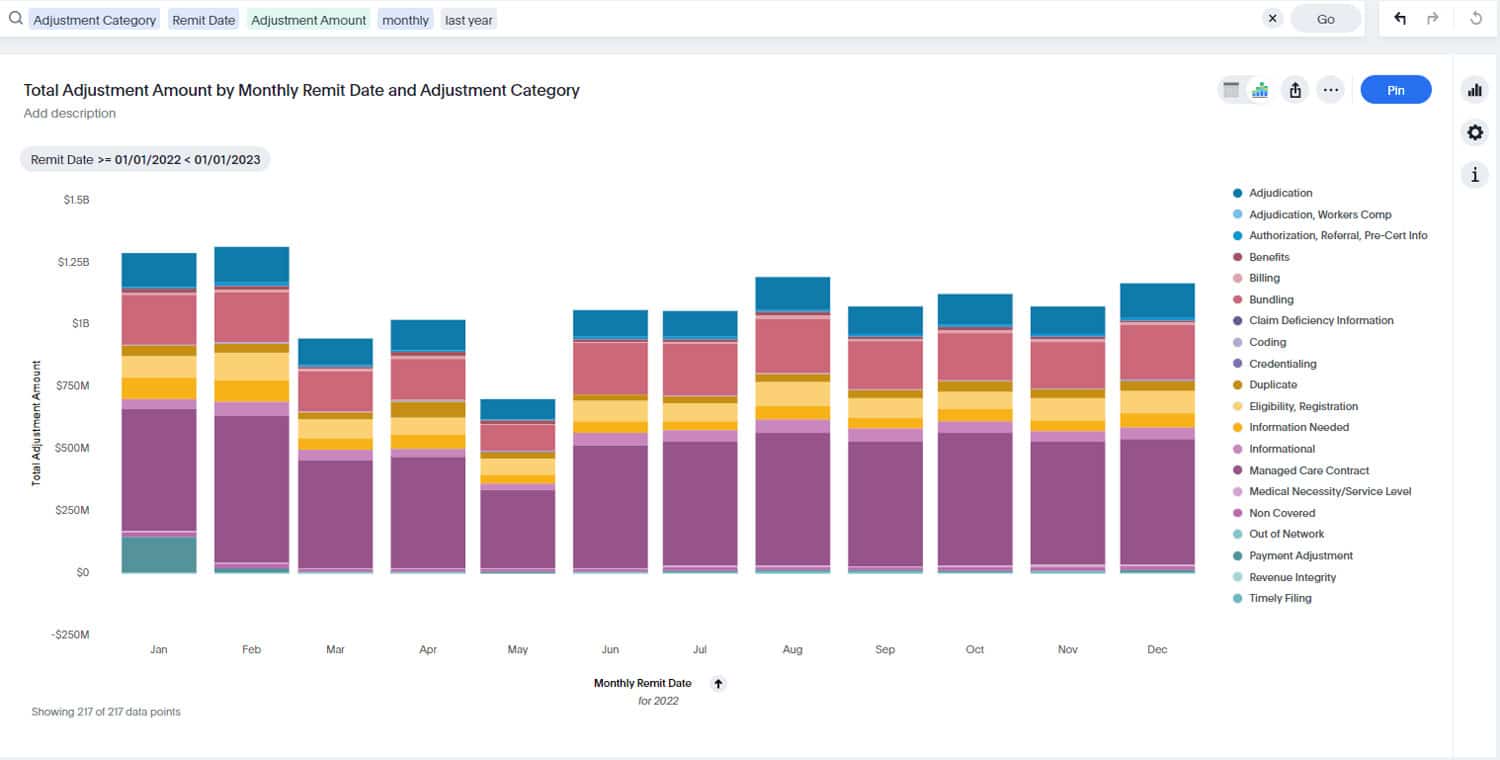

In the past, audits garnered only limited insights for the compliance and leadership teams. With MDaudit, the customer can better identify risks and focus on precious resources. “We use ad hoc reports or drill into Revenue Optimizer to drive our annual work plan so that more time is spent analyzing root causes, rather than just auditing”. The team is now able to review more types of denials with more granularity – including those caused by compliance issues, medical necessity, additional documentation required and more, to decrease financial risk.

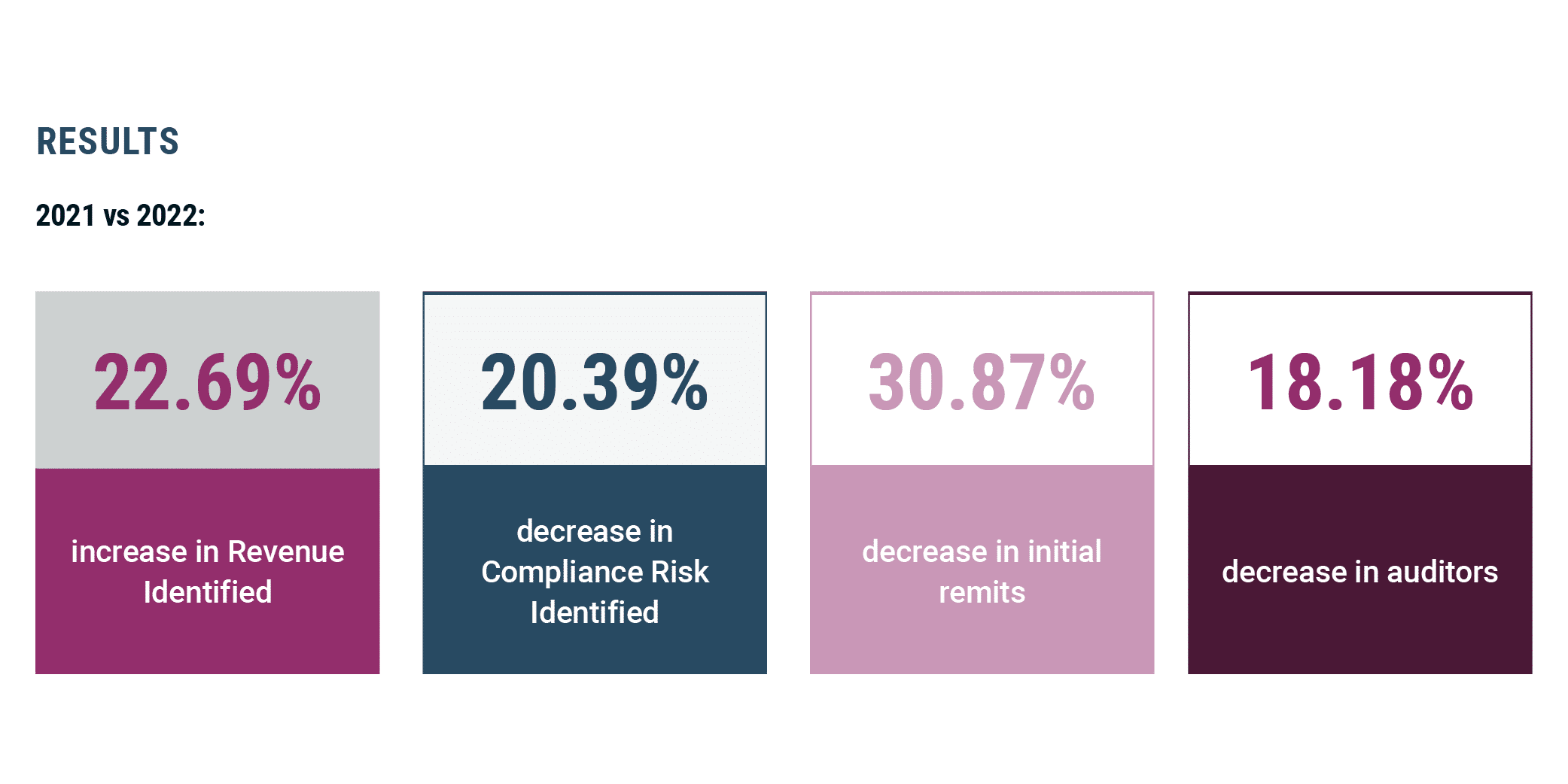

Despite staffing and budget cuts, the customer revenue cycle compliance team is leveraging technology to do more with less. Though the team has fewer auditors, and the health system experienced a 31% decrease in initial remits from the prior year, they were able to identify nearly 23% more revenue while decreasing compliance risk by 20%. “The information we are procuring from MDaudit and passing to other teams is helping to drive a downward trend in denials and an increase in reimbursement,” says the Director of RCC.

THE RESULTS