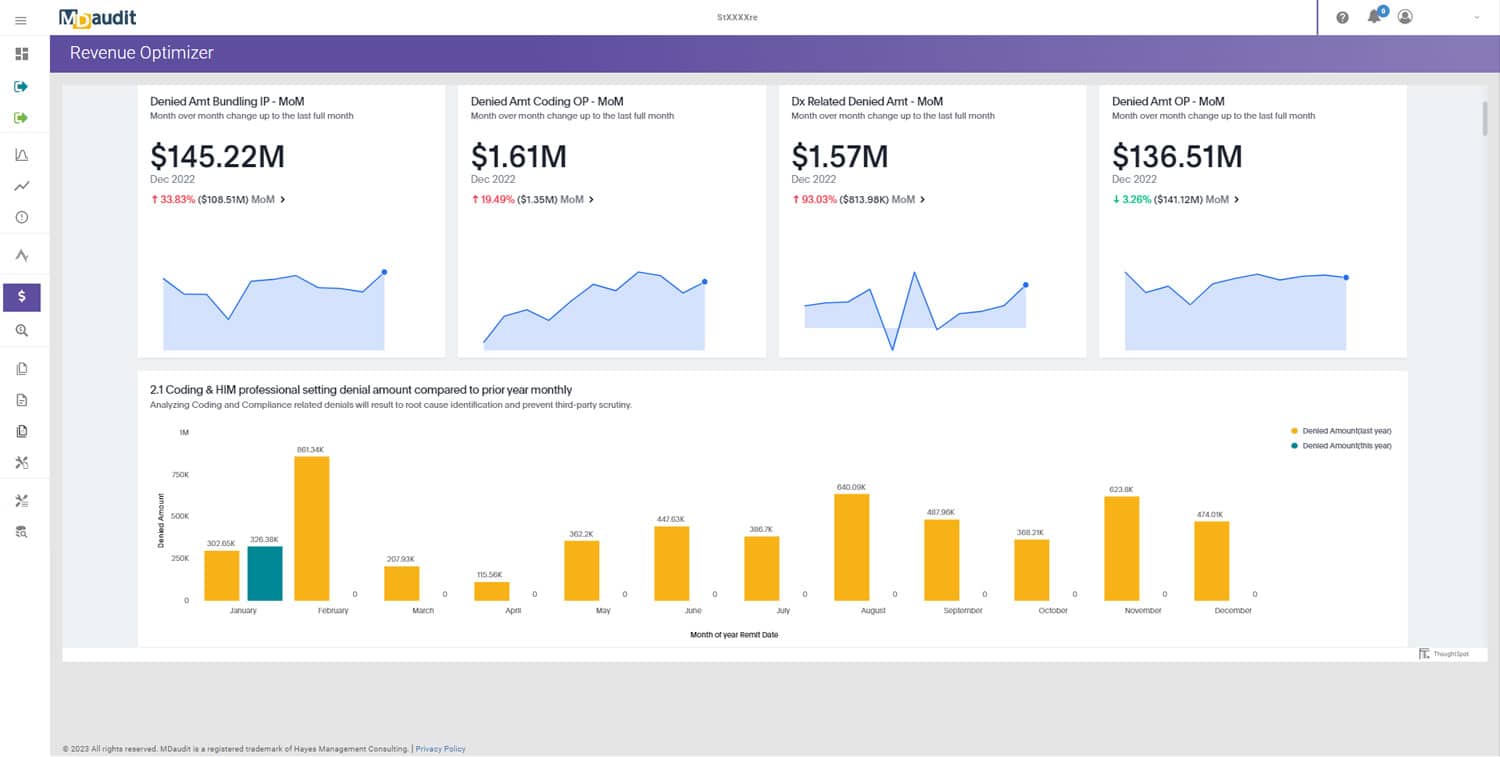

For C-suite decision-makers needing key insights to optimize coding, billing, and revenue outcomes- an enterprise platform plays a pivotal role in guiding strategic decisions at the C-suite level. As healthcare organizations strive to optimize revenue while maintaining compliance here are seven key revenue integrity reports that healthcare executives should focus on to drive meaningful outcomes in their organizations.

- Charge Capture Accuracy: This information provides insights into the accuracy of charge capture processes, highlighting any discrepancies between services rendered and charges submitted. By analyzing this data, C-suite executives can identify areas of improvement in charge capture workflows, reduce revenue leakage, and enhance overall revenue integrity.

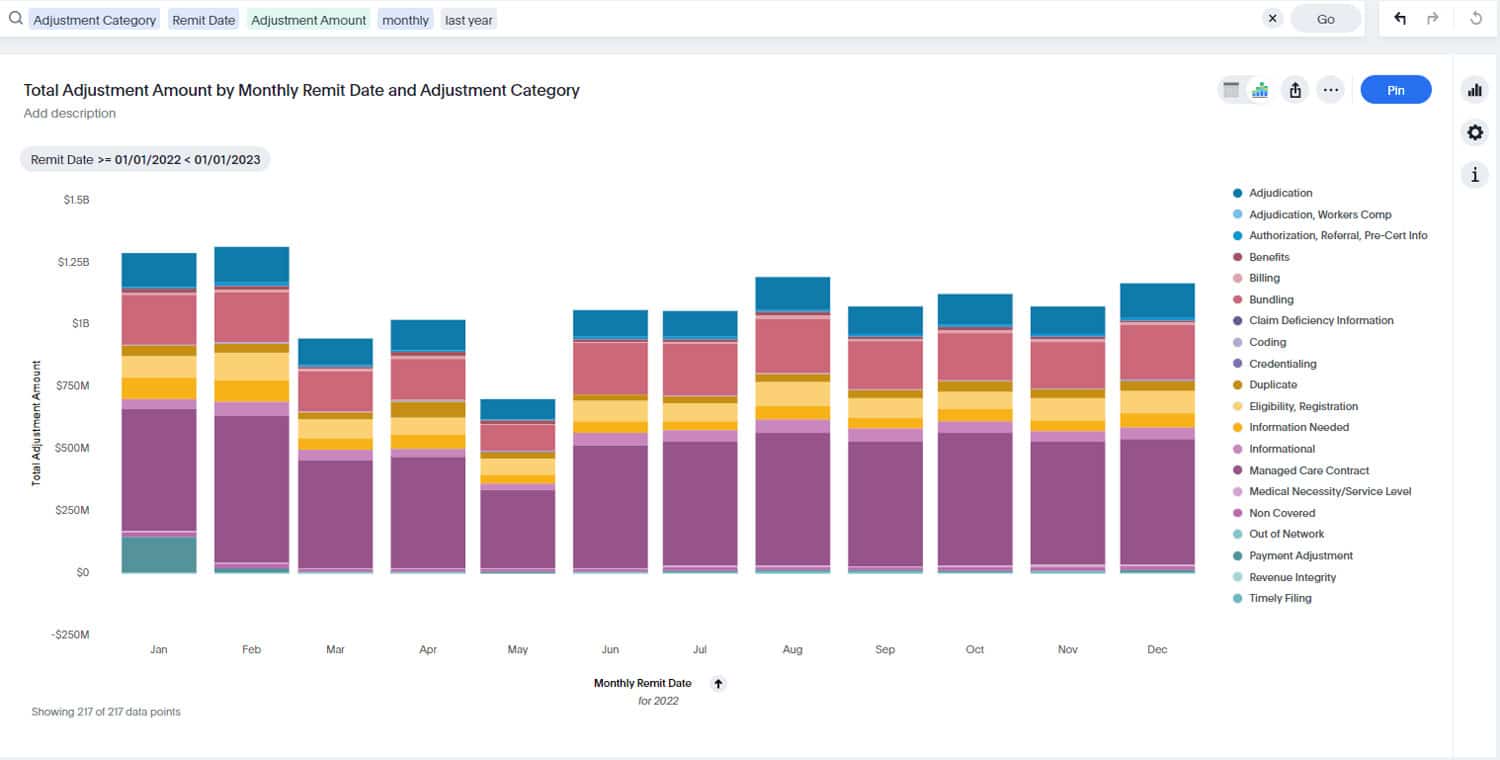

- Denial Rate Analysis: Denials can significantly impact revenue and operational efficiency. Monitoring denial rates through comprehensive reports allows executives to pinpoint common denial reasons, track denial trends over time, and implement targeted strategies to reduce denials. This proactive approach not only improves revenue but also enhances billing compliance.

- Coding Compliance Metrics: Accurate coding is crucial for proper reimbursement and compliance with regulatory requirements. Revenue integrity reports should include metrics related to coding accuracy including overcoding and undercoding error rates, coding quality audits, and coding-related denials. These insights empower executives to address coding challenges, invest in coder education, and ensure coding practices align with industry standards.

- Reimbursement Variance Analysis: Understanding reimbursement variances across payors and service lines is essential for optimizing revenue. Executives can leverage variance analysis reports to identify discrepancies in reimbursement rates, negotiate favorable contracts with payors, and implement strategic pricing strategies. This data-driven approach helps maximize revenue while maintaining financial sustainability.

- Compliance Monitoring Dashboard: Compliance with billing regulations and payor guidelines is non-negotiable in healthcare. A compliance monitoring dashboard consolidates key compliance metrics, such as RAC audit findings, OIG compliance reviews, and coding audits. C-suite leaders can use this dashboard to ensure adherence to regulatory requirements, mitigate compliance risks, and foster a culture of ethical billing practices.

- Revenue Cycle Performance Metrics: Monitoring overall revenue cycle performance is essential for assessing operational efficiency and financial health. Reports encompassing revenue cycle KPIs provide a comprehensive view of revenue cycle effectiveness. C-suite executives can then strategize initiatives to streamline revenue cycle processes, accelerate cash flow, and optimize revenue generation.

- Trend Analysis and Forecasting: Predictive analytics play a crucial role in anticipating revenue trends and forecasting future financial outcomes. By analyzing historical data and market trends, executives can make data-driven decisions regarding resource allocation, budget planning, and revenue growth strategies. Trend analysis reports empower the C-suite to stay ahead of industry shifts and proactively address financial challenges.

The right platform will employ augmented intelligence (AI) and sophisticated analytics to show the aforementioned information while also allowing the C-suite to create their own dashboard and visualizations in a seamless manner.

Revenue integrity reports serve as strategic tools for healthcare executives navigating the complexities of revenue management, compliance, and operational efficiency. By leveraging these reports effectively, C-suite leaders can drive meaningful outcomes, expand patient care initiatives, and achieve a healthy bottom line.