Healthcare compliance has never been more complex. Federal and state regulators intensify oversight, payers deploy advanced analytics to challenge claims, and patients expect transparency. Meanwhile, organizations face mounting financial pressure as denial rates climb and payer audits expand.

For many compliance and revenue integrity leaders, the challenge is fragmentation. Audit data, denial trends, and payer outcomes exist—but they are scattered across teams, spreadsheets, and disparate systems. The result is a reactive, siloed approach where issues are addressed in isolation rather than connected into an enterprise-wide view of risk.

To move forward, organizations need to evolve from audit defense to a proactive compliance strategy. That means turning audit intelligence into an enterprise-wide risk mitigation strategy. With MDaudit’s Audit Workflows, Coder Workflow, Revenue Optimizer, Payer Audit Management, and AI-Powered Technology, compliance teams can close the loop between audit findings, denial prevention, education, and strategic risk management.

Why Compliance Needs a Proactive Model

Growing Regulatory Complexity

Medicare and Medicaid rules evolve constantly, and commercial carriers layer their own requirements on top. Keeping up with NCDs, LCDs, and payer-specific medical necessity criteria requires more than manual monitoring.

Financial Exposure

Denials and takebacks represent billions in lost revenue across the industry. Even when successfully appealed, they increase days in A/R and administrative costs.

Reputational Risk

A pattern of compliance failures erodes trust with regulators, payers, and patients. It can also trigger audits by CMS, OIG, or DOJ.

Resource Constraints

Compliance and HIM teams face rising workloads without corresponding increases in staff. Automation and data-driven insights are essential to scaling their efforts.

What Is Enterprise-Wide Risk Mitigation?

Enterprise-wide risk mitigation is about breaking silos. Instead of treating audits, denials, and payer reviews as separate issues, they are connected into a unified framework.

- Audits: identify errors, coding gaps, and payer-specific vulnerabilities.

- Denials: reveal systemic issues in documentation, coding, and front-end workflows.

- Payer Audits: provide intelligence on how carriers enforce policy.

- Education: closes the loop by addressing vulnerabilities at their source.

- Financial Analytics: quantify risk exposure and measure the impact of interventions.

Together, these elements create a continuous cycle of learning and improvement.

How MDaudit Enables Proactive Compliance

Audit Workflows

Audit Workflows centralize audit activity, automate routing, and ensure findings are captured consistently. This creates a defensible record of compliance activity.

Coder Workflow

With Coder Workflow, audit outcomes feed directly into coder education. This ensures targeted, case-based training that reduces the likelihood of repeat issues.

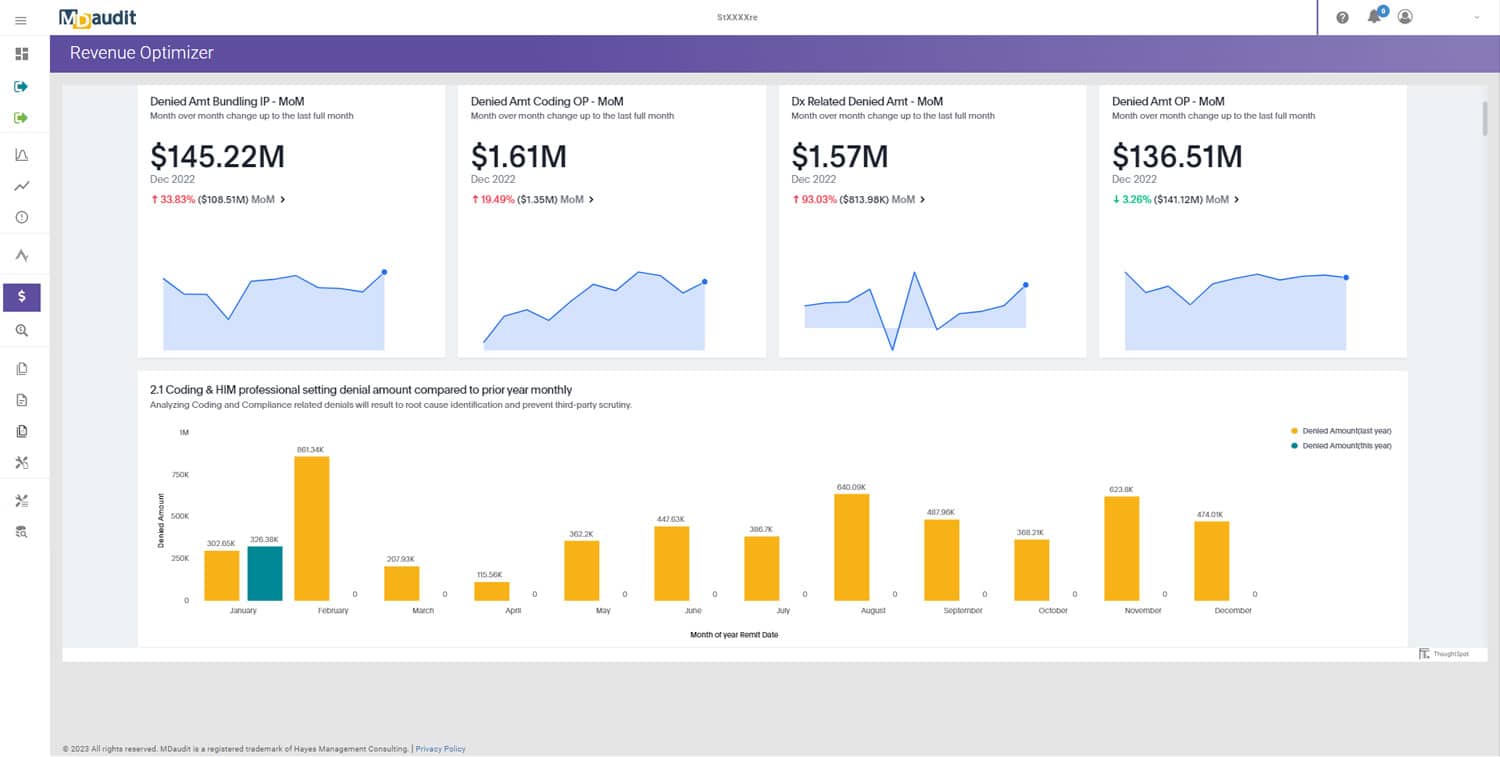

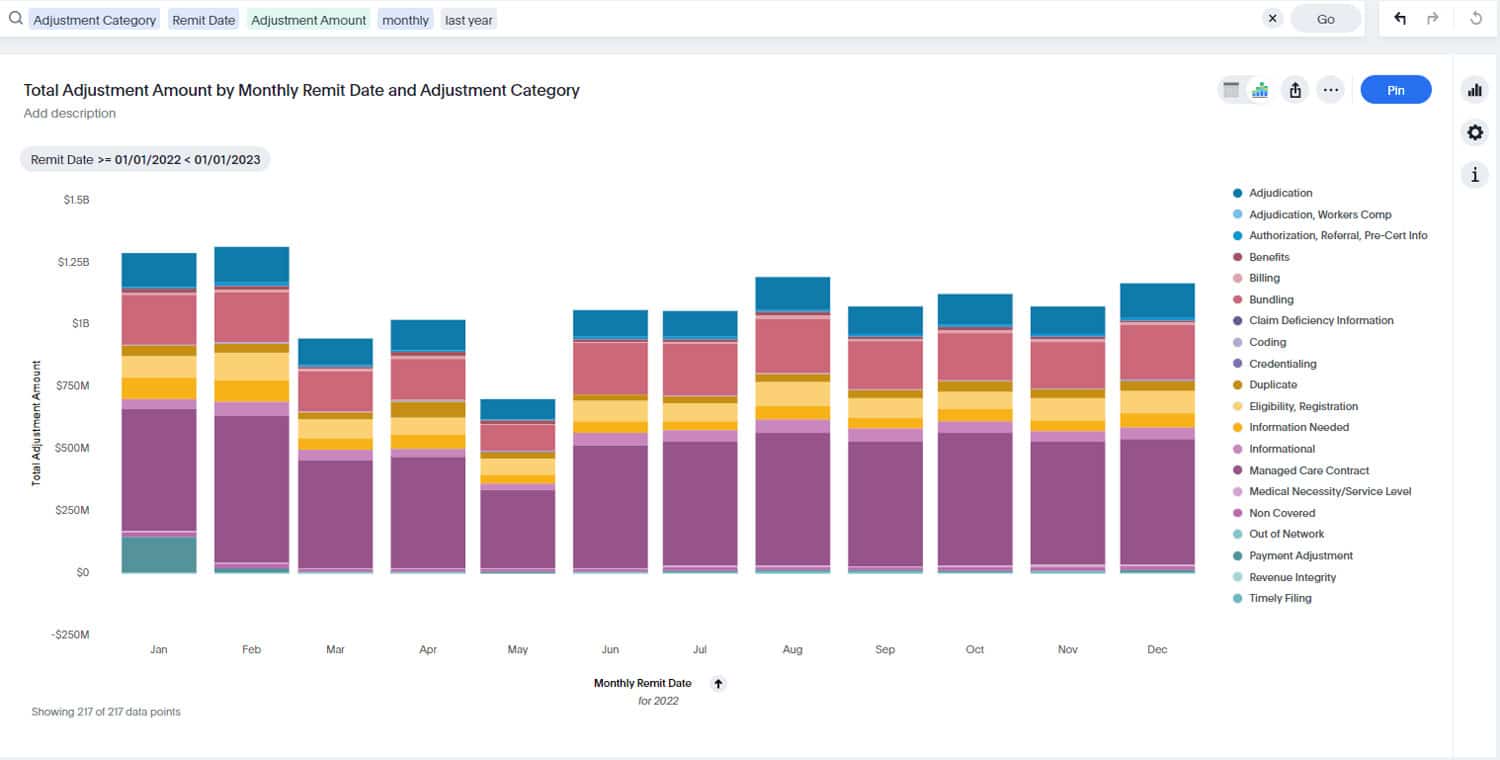

Revenue Optimizer

Revenue Optimizer translates compliance risk into financial terms. Leaders can quantify the dollar impact of denials, downgrades, and payer audits.

Payer Audit Management

Payer Audit Management consolidates payer audit requests, tracks deadlines, and captures outcomes for analysis.

AI-Powered Technology

AI-Powered Technology identifies emerging denial trends, clusters systemic payer issues, and predicts high-risk claims—empowering compliance teams to act before risks materialize.

Building the Compliance Cycle

1. Capture Intelligence

Every audit, denial, and payer request is logged and categorized. No data is lost in spreadsheets or email threads.

2. Analyze Patterns

Cross-payer analytics highlight inconsistencies, systemic vulnerabilities, and shifting payer strategies.

3. Quantify Risk

Financial impact is calculated, enabling executives to see the cost of compliance failures and the ROI of corrective action.

4. Educate Stakeholders

Coders, providers, and billing staff receive targeted training based on real-world findings.

5. Improve Strategy

Insights feed into payer negotiations, compliance planning, and enterprise risk frameworks.

6. Repeat Continuously

The cycle repeats, turning compliance into a proactive, self-improving system.

Scenarios of Enterprise Risk Mitigation in Action

Medicare Advantage DRG Downgrades

Audit intelligence shows multiple carriers downgrading cardiac procedures. Coders are retrained, documentation templates are updated, and managed care leaders present financial evidence in negotiations. Denials fall by 25%, and contract terms are clarified.

Specialty Pharmacy Claims

A commercial payer denies high-cost infusion drugs despite compliant documentation. Audit outcomes prove consistency with peer payers, leading to contract revisions. Revenue leakage drops by millions annually.

Imaging Site-of-Care Policies

Cross-payer analytics reveal one payer denying outpatient imaging at five times the rate of others. Managed care teams leverage the evidence, securing carve-outs for certain service lines.

Medicaid MCO Variability

Audit results show wide variation in denials across Medicaid MCOs. Standardized reporting provides state regulators with evidence of inconsistency, resulting in policy clarification.

Governance for Proactive Compliance

To embed enterprise-wide risk mitigation, governance is essential:

- Cross-Functional Teams: compliance, HIM, revenue integrity, managed care, and finance collaborate.

- Standardized Taxonomies: denial categories are normalized across payers for consistent analysis.

- Regular Reporting: executives receive quarterly updates on compliance risk and financial impact.

- Escalation Protocols: systemic payer issues are elevated to contract negotiations.

Executive Perspectives

CFOs

Gain visibility into compliance risk as a financial exposure, improving reserve forecasting and cash predictability.

Compliance Officers

Demonstrate proactive compliance to regulators, supported by defensible audit trails and corrective actions.

HIM Leaders

Leverage real-world audit findings for coder education, improving accuracy, and reducing denial-driven rework.

Managed Care Leaders

Use compliance intelligence as evidence in payer negotiations, strengthening the organization’s bargaining position.

Future Outlook: AI-Driven Risk Mitigation

The future of compliance is predictive. With AI and machine learning, organizations will:

- Forecast which claims are most likely to be denied or audited.

- Detect payer policy changes before they impact reimbursement.

- Auto-generate compliance risk dashboards for executives.

- Build negotiation playbooks directly from audit intelligence.

This shift ensures compliance is not just reactive, but a forward-looking driver of financial and operational resilience.

Turning Intelligence Into Enterprise Advantage

Compliance cannot be confined to retrospective audits and siloed reports. To thrive in today’s environment, healthcare organizations need a proactive model where audit intelligence drives enterprise-wide risk mitigation.

With MDaudit, that model is possible. Through Audit Workflows, Coder Workflow, Revenue Optimizer, Payer Audit Management, and AI-Powered Technology, compliance programs evolve from reactive defense into a proactive strategy.

To learn how MDaudit can help your organization strengthen compliance and mitigate risk across the enterprise, visit our demo request page or contact us.