According to one recent industry report, hospitals experienced strong volumes and operating margins in the first four months of 2025. However, looking beneath the surface of some revenue cycle management (RCM) key performance indicators reveals that healthcare organizations are still reeling from an onslaught of denials from payers in 2025.

Below are some key statistics from the first five months of 2025 compared to 2024 according to the MDaudit analysis from their benchmarking database covering approximately 800,000 providers and more than 4,000 facilities across over 40 US states.

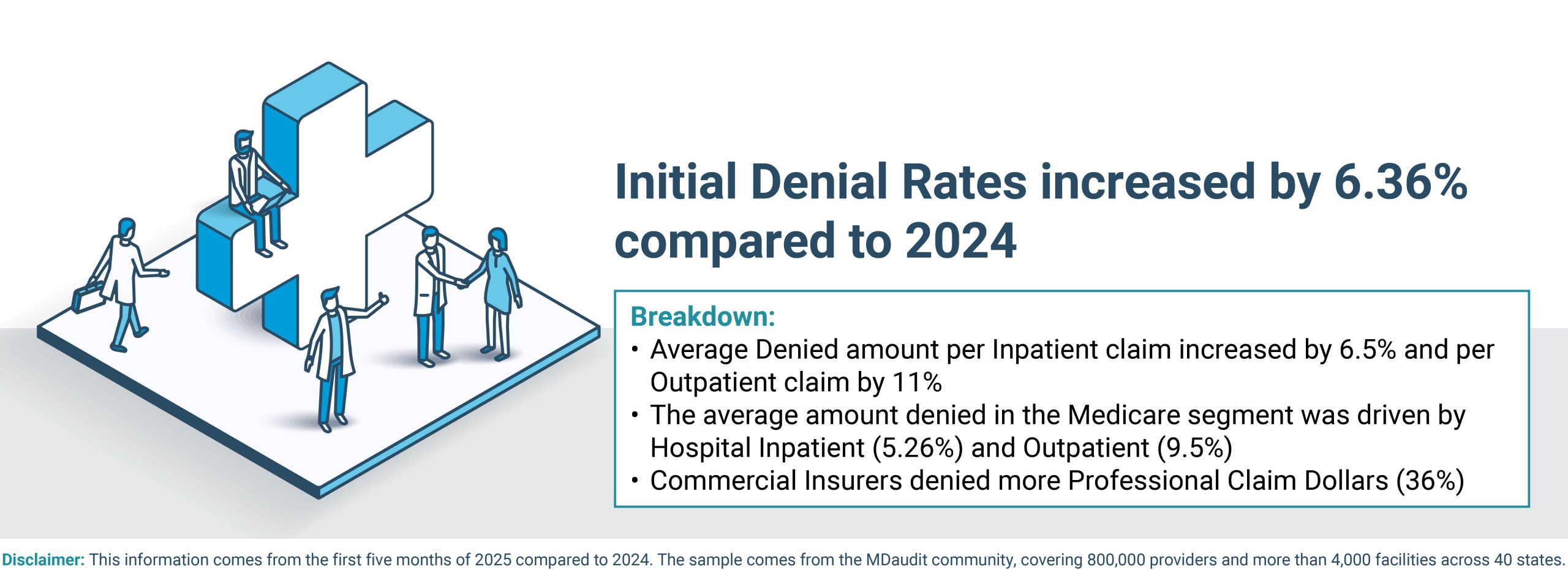

- Initial Denial Rates

Initial Denial Rates increased by 6.36% compared to 2024. Average Denied Amount per Inpatient Claim increased by 6.5% and per Outpatient claim by 11%. The average amount denied in the Medicare segment was driven by Hospital Inpatient (5.62%) and Outpatient (9.5%) claims, whereas commercial insurers denied a higher proportion of Professional claim dollars (36%). This metric has real implications for hospital finances and cash flow.

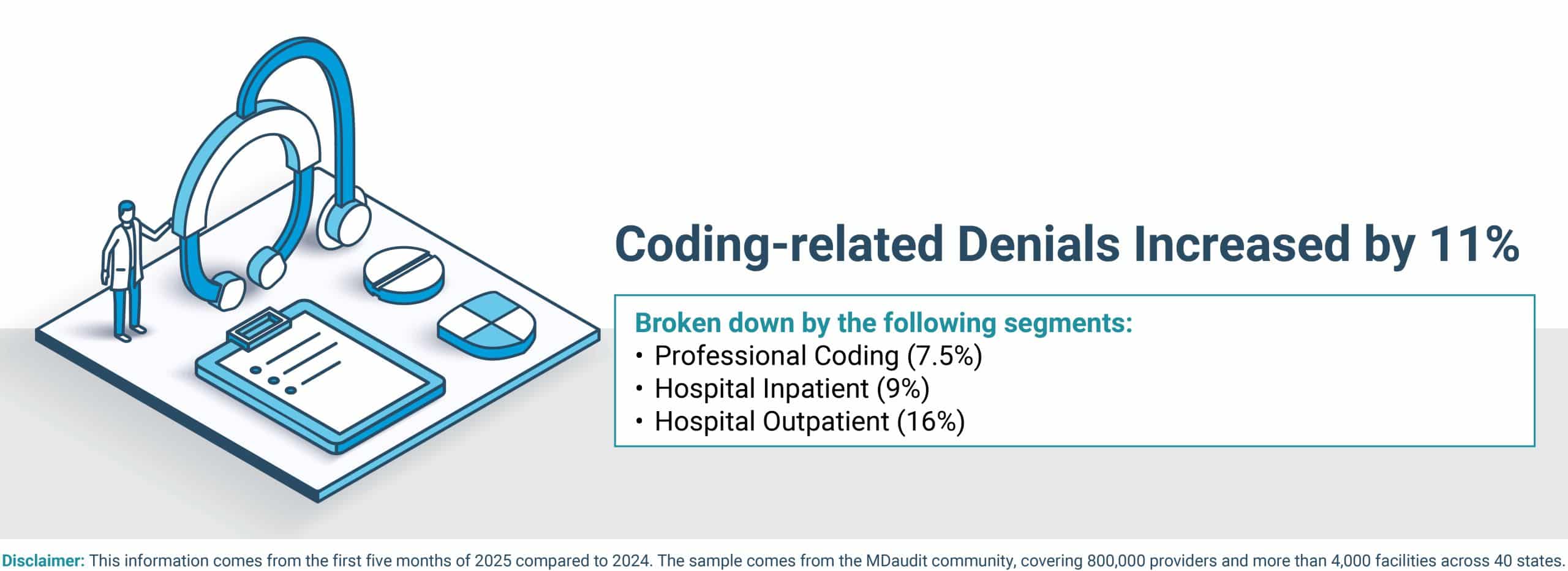

- Coding-related Denials

Coding-related denials increased by 11%. When broken out by segments, Professional coding-related denials rose by 7.5%, Hospital Inpatient was up 9%, and Hospital Outpatient increased 16%. In our 2024 Benchmarking Report, we identified coding integrity as one of the biggest opportunities for healthcare organizations. Deploying technology is not sufficient; humans need to be trained to help with coding integrity, governance, and quality control

- Average Length of Stay

The Average Length of Stay (LOS) was relatively flat at 8-9 days. This metric is one shining spot for healthcare organizations as a leading indicator of well-managed utilization capacity and resources for Inpatient admissions

- Case Mix Index

The case mix index was relatively flat, averaging approximately 2.3. Putting this in context, a recent report suggested that hospitals are managing patients better and more quickly by placing case managers in different care settings, thus reducing LOS. Looking at this metric through the lens of 2025 initial Inpatient and Outpatient denial rates reveals ample opportunities for hospitals to improve coding and clinical documentation.

- Payer Audits

The total at-risk dollars and case numbers increased nearly 2.5 times for healthcare provider organizations in 2025. Hospital Inpatient and Outpatient cases saw more scrutiny due to their increased reimbursement value relative to professional claims.

Recently, we have heard about the Centers for Medicare and Medicaid Services’ strategy to enhance and accelerate Medicare Advantage audits. This, coupled with other payer reimbursement pressures, makes it incumbent on healthcare providers to deploy a proactive and cohesive revenue integrity strategy that involves investments in technology, analytics, and people.

Says Ritesh Ramesh, CEO of MDaudit, “Healthcare provider organizations that put real-time data, technology, AI and analytics, and automation to work and implement strategies that prioritize revenue optimization and risk mitigation while connecting resources across the mid-cycle and back-end of their RCM functions with continuous risk monitoring capabilities will be successful in their pursuits this year.”